Leading biotech organizations are pushing boundaries in therapeutic innovation, advancing cell therapies, rare disease interventions, and precision medicine. AI-powered drug discovery platforms are identifying viable targets faster than ever before. Adaptive designs and real-world data are shaping smarter clinical trials.

To achieve their tall goals, Biotech companies often engage multiple CROs across various phases of clinical trials. Each CRO may follow different billing models, milestone structures, and revenue recognition rules—leading to complex, multi-party contracts that require careful reconciliation across siloed systems. This complexity, compounded by manual accounting processes, turns accruals and reconciliations into time-consuming, error-prone tasks.

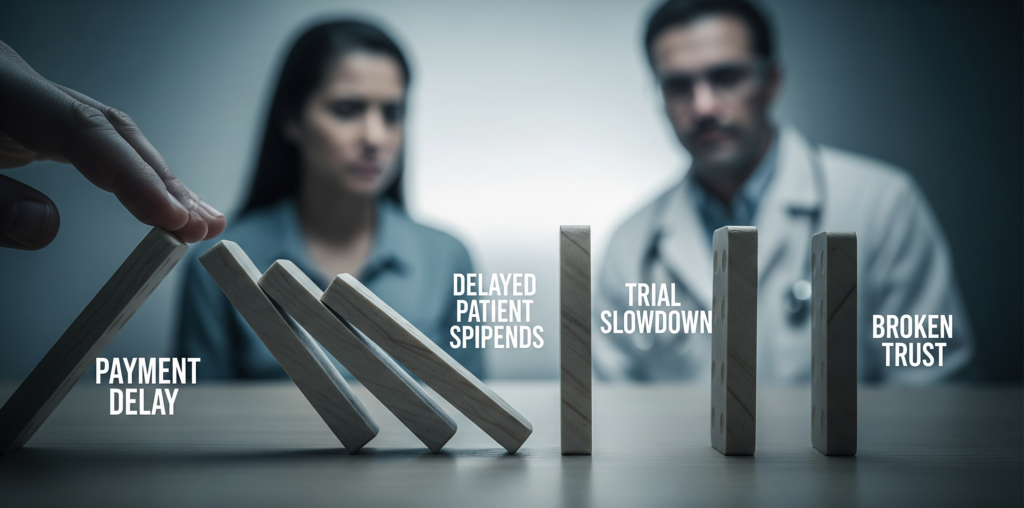

The result: payment delays, compliance risks, and finance teams buried in spreadsheets instead of scaling operations. Manual tracking of pass-through costs, milestone invoicing, and revenue recognition can’t keep up with the intricacies of multi-CRO arrangements. Errors multiply, audits become painful, and financial close cycles drag, hindering timely, data-driven decisions.

In a field where precision and speed are critical, biotech CFOs are often blindsided by a lack of real-time visibility into clinical and financial data, struggling to confidently report progress, budgets, and forecasts, thereby undermining stakeholder trust and strategic planning.

The Real Problem: The Hidden Costs Undermining Profitability

Biotech firms demand real-time visibility and ASC 606-compliant billing, yet many CROs still rely on fragmented tech stacks and offline trackers. Clinical Research Organizations (CROs) don’t just execute protocols—they meet contractual obligations tied to financial milestones. The absence of programmatic milestone validation leads to delays in drug launches and ultimately results in lost revenue

Key Friction Points

- Milestone Payment Delays: The challenge lies in creating a single, validated source of truth between the biotech and the CRO’s systems. Proving work completion across disparate Clinical Trials Management Systems (CTMS), Electronic Data Capture (EDC) platforms, and site logs becomes a slow, manual process of data chasing. Without an automated validation layer that both parties can trust, this creates crippling bottlenecks for cash flow and strains client trust.

- Accrual Blind Spots and Revenue Recognition Disputes: In complex clinical engagements, accurately recognizing revenue tied to milestones requires synchronized tracking of performance obligations. When trial data is siloed across systems, it creates timing mismatches that disrupt ASC 606 compliance. This data gap makes it nearly impossible for biotech finance teams to receive timely, accurate information from their CRO partners to calculate monthly clinical trial accruals. This often leads to payment delays, high-risk manual accrual estimates, reconciliation challenges, and disputes over milestone fulfillment.

- Reconciliation and Audit Overhead: From invoice matching to quarterly close, clinical finance professionals spend dozens of hours chasing data, reconciling spreadsheets, and documenting clinical trial activity manually.

- Reputational Risk and Breakdown of Trust: When financial systems can’t validate progress in real time, the consequences reach far beyond the balance sheet. Milestone delays don’t just delay payments; they can hold up patient stipends and slow clinical trial momentum. This operational fragility erodes the trust between Biotech companies and CROs, turning what should be a partnership into a source of friction and risking future collaborations.

“If your finance operational workflow can’t keep up with your science, you’re not just losing time, you’re risking client relationships and future contracts.”

Automating Multi-party reconciliation with Smart Contracts: The Modern Financial Framework

Solving these systemic issues requires a new operational model, one that connects clinical trial execution with financial workflows via real-time, validated data. This modern framework is built on a foundation of three core components, with smart contracts acting as the automation backbone that drives compliance and efficiency.

Core Components of the Smart Contract-Driven Framework:

- Immutable Source of Truth: A permissioned, tamper-proof ledger captures all milestones, contract amendments, and clinical trial data in real time. This creates a single, verifiable record that both the biotech company and CRO can trust, eliminating the root cause of most data disputes.

- Smart Contract Automation: More than just digital agreements, smart contracts are programmable logic that enforces contractual terms. They automatically execute the crucial steps of ASC 606 identifying performance obligations, allocating transaction prices, and recognizing revenue precisely when fulfillment occurs. This removes manual intervention and subjectivity.

- Cross-Entity Transparency: The framework provides a shared, synchronized view that connects the Clinical Operations, Project Management, and Finance teams at the biotech company with their direct counterparts at the CRO. When a clinical team validates a milestone, the financial data is instantly and automatically available to finance professionals at both organizations. This eliminates information silos, prevents reconciliation delays caused by email chains and manual reports, and ensures all parties are working from a single source of truth for seamless audits.

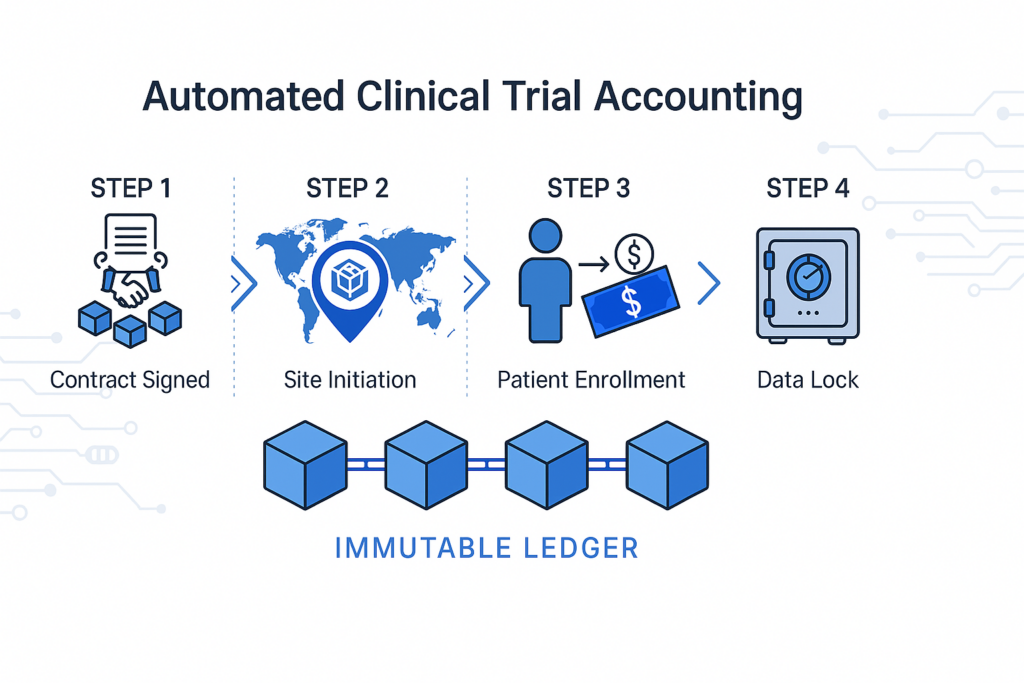

Here’s How It Works

This framework transforms the cumbersome manual process into a simple, auditable, three-step flow:

- Encode: Financial rules, payment terms, and SOW obligations are embedded directly into a smart contract at the start of a clinical trial.

- Validate: Real-time data from your CTMS, EDC, or other site-level systems feeds directly into the framework, automatically validating milestone completion against the pre-defined rules.

- Execute: Upon validation, financial events like milestone payments and revenue recognition are triggered instantly. Each action is recorded immutably on the ledger for a permanent audit trail.

This process replaces lagging approvals and spreadsheet-driven reconciliation with rule-based execution, automating compliance with ASC 606 by design. It also aligns with global clinical standards such as EMA Clinical Trials Regulation and ICH GCP E6 (R2), ensuring the traceability and data integrity required by regulators.

Path to ASC 606 Compliance, Automation, and Accrual Accuracy

The true cost of legacy financial systems isn’t found in a single delayed milestone, but in the cumulative drag of hundreds of manual back-office actions that burden both biotech and CRO teams every quarter. Tasks like these consume valuable resources and create constant friction:

- For Biotechs: Manually chasing CROs for data to calculate accrual estimates.

- For CROs: Manually compiling reports to prove milestone completion.

- For Both: Manually reconciling contracts, site fees, and deferred revenue schedules.

This is where the smart contract framework moves from theory to practice. By linking validated clinical events directly to pre-defined financial rules on a shared ledger, the system transforms these burdensome manual processes into automated, transparent workflows. This shift from reactive, spreadsheet-driven accounting to proactive, operational intelligence delivers powerful, mutual benefits across the entire biotech-CRO partnership:

- Real-Time Revenue Recognition & Accurate Accruals: CROs can recognize revenue the instant a milestone is validated, while biotech organisation gain a real-time, accurate basis for calculating accruals, ensuring ASC 606 compliance for both parties.

- Collaborative Trust Through Transparency: A shared, unchangeable view of contractual obligations and fulfillment eliminates the reconciliation, building a foundation of verifiable trust.

- Unified, Audit-Ready Compliance: The system generates a single, immutable audit trail that is regulator-ready for both financial standards (ASC 606, SOX) and clinical regulations (21 CFR Part 11).

- Accelerated Financial Close & Reduced Costs: By automating data exchange and reconciliation, the framework drastically reduces manual effort, enabling a faster, more accurate quarterly close for both organizations.

- Enhanced Data Integrity for Forecasting: Real-time data feeds directly into analytics platforms, empowering biotech and CRO finance teams to forecast revenue and expenses with far greater accuracy.

Putting Smart Contracts to Work: Your Bridge Between Science and Finance

This modern operational framework requires more than just a concept; it requires an enterprise-grade platform built to handle the complexities of the life sciences industry. This is precisely why we built FLEXBLOK.

We recognized that the core problem was not a lack of data, but the absence of a shared, trusted bridge to synchronize clinical and financial systems. The FLEXBLOK Blockchain as a service platform is that bridge. It is the practical application of the smart contract framework, designed to integrate directly with the technology you already use (ERP, CTMS) through secure, industry-specific APIs.

FLEXBLOK delivers the shared infrastructure that automates the workflows between biotech companies and CROs. It is specifically designed to:

- Automate the multi-party milestone reconciliation and approval process, dramatically shortening the cash flow cycle for CROs and providing real-time budget visibility for biotech firms.

- Generate immutable, audit-ready evidence for every transaction, simplifying compliance for both partners.

- Provide a real-time, accurate data source for calculating accruals, eliminating a major source of financial uncertainty for biotech organizations.

- Resolve revenue recognition discrepancies through a shared, real-time ledger that acts as the single source of truth.

This is the platform that closes the gap between your science and your financial operations.

Conclusion: Make Accounting as Agile as Your Science

The future of clinical trial finance isn’t faster spreadsheets; it’s smarter, unified infrastructure.

By adopting a blockchain-powered framework, biotechs and CROs can finally align their financial operations with their scientific ambitions, building unbreakable trust and ensuring compliance by design.

Explore how FLEXBLOK can eliminate financial friction, deliver timely and accurate data, and turn your clinical trial accounting from a liability into a strategic advantage.

See how your next trial can run on verifiable trust.